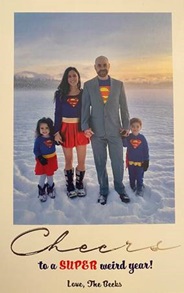

My son and daughter-in-law sent out a creative photo-card this holiday season, with the apt greeting: “Cheers to a SUPER weird year!” Yes, 2020 was a seriously weird year. Economically, pandemically, politically…and in terms of climate change and energy.

A psychological barrier was crossed in 2020. When the world’s economy went into its protracted stall and people everywhere stopped driving and flying for many months, there was clear evidence that this change in people’s movements had, quite substantially, impacted the short-term trends of carbon emissions and global demand for transportation fuels.

With that evidence in place, that our behavior can palpably impact global CO2 loading, corporate momentum has shifted perceptibly towards more aggressive sustainability targets by the global energy and chemical industries. Lukoil announced in March that it would be planting 33 million trees in the Volga flood plain. In Europe, BP, Shell, Equinor, Repsol and Eni have announced aggressive renewable energy and net zero carbon targets. In the US, chemical giants Dow and LyondellBasell have committed aggressively to the circular economy, among others. And globally, major players Sinopec, Saudi Aramco, SABIC, ADNOC and Reliance have all announced major initiatives.

In 2021, the energy industry globally is expecting continued uncertainty, with challenges in predicting the speed of recovery to the next-normal economy. There’s also much discussion as to the predicted trajectory of the energy transition.

In fact, there is no consensus, and most of the market analysts have presented the future path in terms of at least three widely divergent pathways. One crucial variable at play is regional and global GDP growth, which is seen as very dependent on the persistence of, or recovery from, the worldwide pandemic.

In the midst of that, many companies are ramping up their digital transformation efforts.

In a survey of 220 companies just completed this month, Crystol Energy and AspenTech reported that 18% of companies noted a significantly increased focus on digitalization when comparing their digitalization priorities pre- and post-pandemic.

Why?

Sustainability has already started to drive investment in digitalization initiatives to support the need to accelerate innovation and change. The pace of investment will pick up in 2021.

Globally, the energy transition has gained strong momentum and inevitability as we move into 2021.

What are some of the key business and technology trends that we see playing out in 2021 among the energy players in Asia?

- Continued focus on digitalization. Energy companies globally accelerated their digitalization programs in 2020 in response to economic and energy market shocks. The impacts have been larger than were anticipated. We expect that the focus and scope of digitalization in 2021 will increase.

- The past nine months have seen a global disruption in terms of the rapid pace of technology innovation. If the innovations being introduced by AspenTech to the market in 2020 and 2021, on the software side, are any measure, the pace of innovation and the value it will create will increase in 2021. Some of this will be applied to support the growth expected through economic recovery (which is already being seen in China but will spread across Asia, eventually reaching the US and Europe later). Some will be applied to achieving sustainability goals, and some will be applied to shifting supply chains and increasing resiliency.

- Continued and concentrated focus on energy efficiency. A razor-sharp focus on increasing the energy efficiency of operations in refining, LNG and midstream can be expected. This makes sense because it both reduces operating cost and carbon footprint.

- Continued progress on carbon reduction. The largest regional energy players will closely follow the “early movers” in Europe and the Middle East to explore and prove out the most promising technology approaches to carbon capture and carbon reduction in the energy value chain.

- Innovation towards new energy sources and new materials. The hydrogen economy is enjoying renewed focus and excitement, despite the many economic and technical challenges still in front of commercialization of hydrogen-fueled power and mobility.

- Shift in production mix in refining towards chemical feedstocks. As economies and middle-class growth both regain momentum, projects such as the proposed Indian RRPCL mega project integrating refining and chemicals, make sense to meet growing and shifting market demand.

- Continued evolution from oil to gas, especially with respect to chemical feedstocks and power generation. Electrical demand will continue to grow, and natural gas will fulfill a crucial need here.

- Transition to more sustainable chemical production. The societal drive towards reduction in wastes in general and plastic wastes in particular will drive Asian integrated producers and chemical producers to continue to innovate and invest in this area.

AspenTech solutions are already playing a key role in many of these innovation areas, driving process innovation, process intensification, techno-economic optimization and accelerating scale-up. For example, Technology Center Mongstad, which is pushing the boundaries of what is possible with carbon capture, use our modeling products to validate the results in their demonstration plants. The world’s leading researchers in algae-to-fuels conversion have used our modeling, energy and economics tools to make breakthroughs in the energy balance and economics of this approach. And researchers developing new-generation process technology for the hydrogen economy, fuel cells, CO2 to chemicals and pyrolysis use our modeling tools as staples in the innovation process. Our exciting new Aspen Hybrid Models technology is extremely well suited to help drive these areas of innovation further and faster.

Stay tuned throughout 2021! To learn more, watch our on-demand webinar, How Changing Economics and Technology will Impact the Energy Industry.

Leave A Comment