ADIPEC 2021, one of the first large scale in-person global energy industry events since the pandemic started, has attracted a broad scope and scale of participants. From 50 CEOs of major global energy players, to energy transition leaders, to 30 ministers of energy, to technology experts, an estimated 80,000 plus people passed through the Al Hosn App (Abu Dhabi’s vaccine and COVID test certification app) checkpoints.

ADIPEC opened with discussion of the diplomatic negotiations and agreements resulting from COP26, which concluded just a few days prior to the ADIPEC opening bell, and with the COP agreements falling short of the clarity of the guidance hoped for by many parties.

At ADIPEC, Neil Brown, Managing Director at KKR Global Institute, expressed that he felt the important shift that COP26 represented is the “mainstreaming of climate,” by which he means climate now comes to the table along with energy affordability, security and reliability as the major factors in considering capital investments. At the same time, the divergence of the upward aiming ambitions coming out of COP26 from the flatter slope of concrete actions leaves a high level of uncertainty and risk that industry and financiers are contending with, largely from policy and regulatory uncertainties.

With that insight, Eduard Ruijs of BlackRock expressed that there are now three important parties who are in position to set the hydrocarbon industry’s direction in the journey toward a low-carbon future, namely industry, financial institutions and governments.

(Ruijs, left, Brown, center, Caballero, right)

An important leadership role in making concrete, substantial and speedy progress in reducing net carbon emissions has now been placed largely in the hands of industry, financiers and NGOs, with the world’s governments falling short of reaching the kind of agreements that climate change activists and much of the global public have been calling for. In the conversation with Brown and Ruijs, Ecopetrol’s CFO, Jaime Caballero talked about the external and internal stakeholders, (which range from financial markets and investors to “our kids”) driving Ecopetrol to the decision to set a net-zero target, which provides a superstructure for plans and action. At the event, Ecopetrol's CEO also transparently talked about their challenges in measuring emissions and their initiative to collaborate with the Colombian government to map out the energy transition future for the country.

Consider that the annual revenues of the top eight global energy companies (not even including CNOOC or CNPC) currently exceed the GDP of all but the top 16 global economies, coming in just ahead of the Netherlands and behind Indonesia.

On the first day of ADIPEC 2021, the energy industry, with many key global leaders present, signaling that they are poised to define their own proactive path forward. Tayba Al Hashemi, CEO of ADNOC Sour Gas and chairman of ADIPEC, said in the lead-in to this important international gathering:

“If the world is going to manage a secure and successful energy transition the role of traditional energy companies, with their expertise, resources and capabilities will be critical…ADIPEC 2021 will provide a much-needed platform for industry leaders and innovators to explore the impact of shifts in government policy and changing demand dynamics, as well as to progress the decarbonization potential of technologies like CCUS and hydrogen.”

As I write this blog from Abu Dhabi, energy companies are expressing in different ways, and with different strategic intent, the opportunity to take the initiative in mapping future progress, and they seem to be in a mood to take it. The momentum has shifted somewhat into the hands of industry who can show their will, commitments and capabilities to embrace and execute change. The international financial institutions hope so and the public will be watching.

The Dual Challenge

Petronas’ CEO, Tengku Muhammad Taufik, presented a pragmatic view of the emerging economy for national oil companies (NOC). He explained that in his first year as CEO, he made the decision to set a 2050 zero carbon target for Petronas, today the third largest exporter of liquefied natural gas (LNG) in the world.

He pointed out that peninsular Malaysia, and next-door-neighbor Indonesia’s island archipelago represent an always-present and visceral view of the challenges of climate change.

At the same time though, he authentically stated that “the economic pain of the Malaysian people today is real” and there is a commitment to supply electricity and fuel at an affordable price. The added complexity being the growing middle class in these countries. For him, an organization like Petronas has an implicit responsibility to supply energy to Malaysia today, affordably, and plan to evolve for the future.

The Hydrogen Opportunity

On day one of the event, Abu Dhabi National Oil Company (ADNOC) and ADQ announced that Japan’s Mitsui & Co., Ltd (Mitsui) and the Republic of Korea’s (Korea) GS Energy Corporation (GS Energy) have agreed to partner with TA’ZIZ and Fertiglobe to develop the world-scale low-carbon blue ammonia facility at the TA’ZIZ Industrial Chemicals Zone in Ruwais. These partnerships are expected to accelerate Abu Dhabi’s position as a leader in low-carbon fuels, capitalizing on the growing demand for blue ammonia as a carrier fuel for clean hydrogen. With this announcement, and several others recently, hydrogen becomes real as a player in the future energy mix.

In an excellent panel discussion moderated by IHSMarkit’s Daniel Yergin, Thyssen Krupp CEO, Sami Pelkonen projected that by 2030 green hydrogen would be cost compatible with blue hydrogen. Yergin pointed out that the limiting factor might be the supply constraint of “green molecules,” and asked what the math is for implementation of green hydrogen. Pelkonen believes there is a 100 GW market for green hydrogen electrolysis by 2030, while acknowledging more optimistic estimates putting the 2030 opportunity at 150-200 GW power from green hydrogen, with the capital cost currently at 500 Euros per kilowatt.

Dr. Felipe Bayón, CEO of Ecopetrol, talked about a Colombian energy “roadmap” the company discussed with the government planners, with potential partners for hydrogen and renewables “lining up.”

Validation of the ADIPEC Viewpoints

Research AspenTech conducted earlier this year (in which over 340 companies responded) has shown that the industry is poised to take net-carbon zero action for good business reasons.

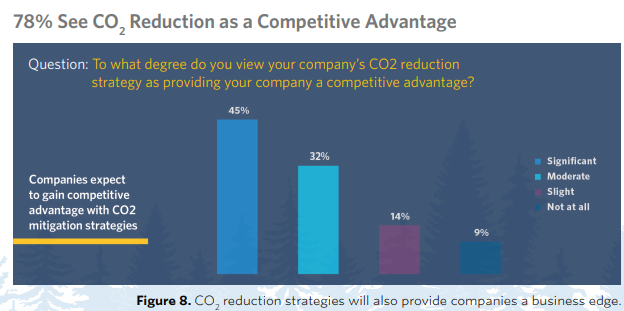

In answering the question, ‘will decarbonization provide your company a competitive advantage’, 78% of some 250 respondents replied yes.

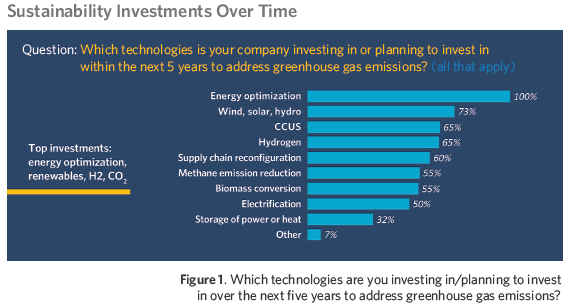

In answering the question, ‘which decarbonization strategies will your company be pursuing in the next five years’, almost every company will be pursuing multiple approaches, as shown in this table:

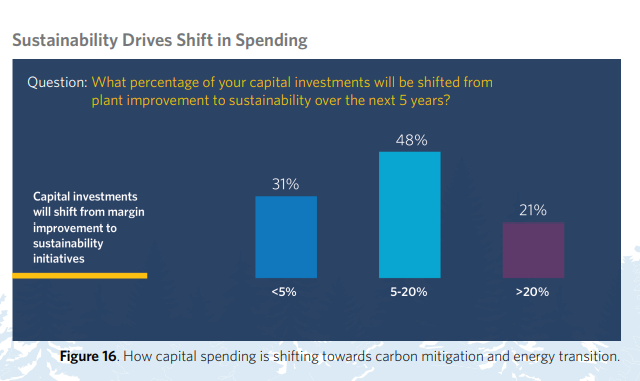

And in answering the question, 'is capital allocation being shifted,' the answer was definitely yes. Quite significantly in fact. So, the internal and external drivers that Ecopetrol’s CFO talked about are clearly taking hold on a broad basis. 48% of companies anticipate shifting 5-30% of their capital allocation towards sustainability initiatives:

While we stand at this juncture, many parties believe that the challenges can only be measured through use of the rapidly evolving technologies of digitalization, AI, data analytics and cloud. We are already seeing great strides being made in the economics of hydrogen, carbon capture, biofeedstocks and other sustainability areas through the application of optimization models and Industrial AI.

Petronas pointed out that governments and NGOs are already using satellite and drone sensors to develop their own independent assessment of the carbon footprint of the broad range of oil assets.

I will report more on the trends and directions expressed at ADIPEC in my next blog. In the meantime, you can review the complete results of our sustainability survey in this report: Sustainability, Decarbonization and Industry Initiatives Survey Findings and Analysis.

Leave A Comment