The refining world has been hit with supply and demand shocks.

Navigating the dynamics of refining economics today, for the refinery executive, is tough. Like navigating an unmapped, turbulent, twisting rapid river, there’s a surprise behind every bend. And the path through the rapids changes as water levels rise and fall (just like supply and demand).

Who does the refinery executive turn to?

The organization’s planners are at the nexus of this. In this territory of future price and demand uncertainty, refinery planners and schedulers are in the hot seat. Refineries are examining new scenarios daily, and each scenario needs to be evaluated for safety, logistics and economics.

Refineries are typically set up to produce predominantly a mix of gasoline, diesel, naphtha (as gasoline and petrochemicals feedstock) and jet fuel. In today’s market — with gasoline and jet fuel in slowly recovering demand and over-supply, and diesel the preferred transportation fuel output — planners and engineers are being asked by executives to rapidly develop refinery plans that maximize diesel.

In tomorrow’s market, with the energy mix in transition (most rapidly in Europe), planners can be strategic in advising executives as to the best CAPEX and process strategies to achieve agility and resilience in the face of uncertain future market evolution. Both questions are being asked now.

Today, a wider range of crudes are available at low prices, which can be enticing, but with future demand and pricing uncertain, refineries can also lose a lot of money if the wrong choices are made. With diesel prices holding better than other product prices, many are focusing their attention on several key refining units, especially the CDU and VDU, where the fractions that yield diesel can be maximized.

It is also clear that in the new normal, assets may need to be operated with fewer staff on site. This requires looking at the interaction between production, catalyst lifetime and asset health and integrity.

There are many cascading, related refining operational questions that planners and engineers are being asked to answer:

- What is our lowest throughput safe operating level?

- Should we order catalysts early?

- Can we make minor process reconfigurations to better utilize our intermediate products?

- What other moves can we make to take advantage of crudes that may be available at lower prices?

- Which operating plans give us better flexibility in face of extreme volatility of prices, supply and demand?

Close collaboration between planners and process engineers is required to answer these questions. A digital solution is the best enabler of rapid response to this challenge. The planning models (typically Aspen PIMS-AO™) used in planning a typical refinery were not originally implemented or tuned for the kinds of eventualities being encountered dynamically today. Before the scenarios can be run with accuracy, the models of these key economic units must be changed to accurately reflect the proposed operating regimes.

The engineering digital twin models of key units are a crucial competitive advantage to obtain a fast, actionable answer. And an automated workflow to enable the engineering model prediction to inform the planning submodel, without significant manual time, provides another critical advantage.

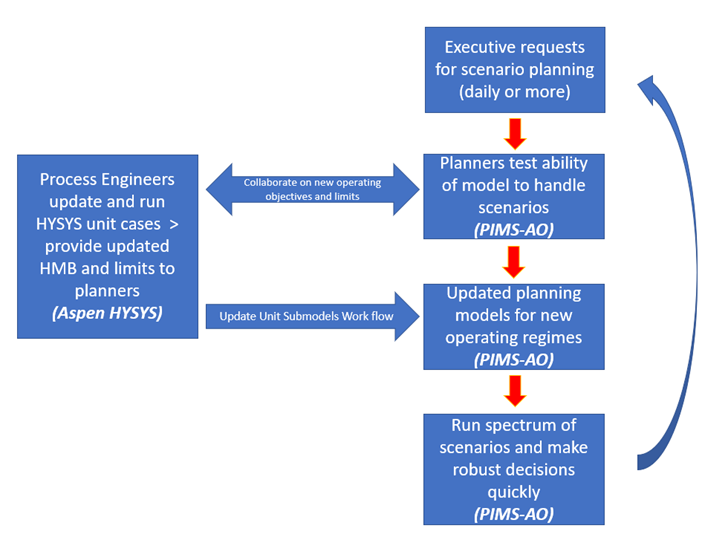

This graphic shows the collaborative work process needed to respond rapidly to the need to scenario plan in this VUCA environment.

Here are the typical steps needed to answer executives’ questions about scenario planning for increased diesel, low jet fuel demand, rapidly changing prices and flexibility for the future.

How do we address dramatically different product mix scenarios (maximizing diesel and minimizing jet and gasoline cuts, being prepared for increased naphtha demand as olefin feedstock)?

- The CDU and VDU submodels, as well as the hydrocracker, hydrotreater and/or FCC submodels in the planning model will most likely need to be quickly and efficiently rebuilt based on a new range of expected operating limits.

- First, the simulation (Aspen HYSYS® Refining or similar) models need to be quickly updated, to match current operating data, and the process alternatives for maximizing diesel cuts and minimizing jet and gasoline cuts need to be created and modeled. By running a sensitivity analysis of planner’s desired options, Aspen HYSYS will inform the safe operating limits for the CDU and VDU and physical properties that need to be used for these new operating regimes.

- Next, those CDU and VDU model results must inform an updating of the planning submodels. AspenTech has a convenient and efficient workflow available for updating the various Aspen PIMS™ submodels and is progressively automating it and incorporating new technology nonlinear models.

- Using the Aspen PIMS-AO planning model, a wide range of crude and pricing products and demand scenarios can be run, to identify the optimal operating plan. Leveraging high performance computing, many scenarios can be run, and in this economic environment the planner may wish to run thousands of sensitivity cases, across a range of possible scenarios, on a daily basis.

How do we address low maintenance operating scenarios (running without heat exchanger fouling cleaning and other routine maintenance)?

- Use Cases in Today’s Volatile Pricing and Demand Environment

- The engineering team runs a range of reactor/preheat train modeling scenarios in Aspen HYSYS to identify operating yields attainable under different heat exchanger fouling cases consistent with different lengths of time that may be necessary to run while deferring all but the most essential plant maintenance.

- Update the planning models with the new operating yields model.

- Run refinery operating scenarios under different maintenance and production scenarios.

Here are a few typical use cases organizations are being presented with which collaboration between engineering and planning can provide rapid scenario planning for a refinery’s executive team:

- Maximize diesel production while minimizing kerosene and gasoline output. Using Aspen HYSYS and Aspen PIMS-AO together, quickly update the planning model, identify safe operating limits, understand feasible changes to CDU, VDU and Kerosene hydrotreater, and understand impact on catalyst life.

- Evaluate crudes available at low prices, which haven’t been used in the refinery previously.

- Evaluate multi-plant economics to make decisions about which refineries to run at which turndown levels, as well as product mix options across circuit of plants.

- Evaluate catalyst lifetime and/or substitutions that will better fit the new operating objectives and make catalyst decisions with the best economics.

- Through scenario planning, advise on the lowest feasible operating levels. Aspen PIMS-AO scenarios can identify economics of different operating levels; Aspen HYSYS can identify safety and operating risk issues.

What Does the Future Hold?

In summary, technology can help refining companies evaluate more scenarios faster in this time of economic turbulence. In this unusual economic time, the refining industry is looking increasingly at applying more digital technology in smarter ways.

As one refining CEO who visited my offices in Boston last fall said at the beginning of our meeting, “When I took over as CEO, my first question was, how good is our planning model? I was told ‘very good.’ But I soon concluded that was not true.”

At the highest levels, an awareness of the key technology tools in your arsenal is key to achieving organization competitive advantage. If the engineering digital twin and planning models are not synchronized and working accurately, this should be a key target for digitalization to support resilience and agility in 2020 and 2021.

And then the planner, engineer and executive will emerge, unscathed ready for the next patch of rough water ahead.

Navigating the dynamics of refining economics today, for the refinery executive, is tough. Like navigating an unmapped, turbulent, twisting rapid river, there’s a surprise behind every bend.

Leave A Comment