Clean energy development in the US is “thriving,” with important policy support enabling deeper investment in new capabilities for the energy transition. This is the overwhelming message from the latest edition of the “Sustainable Energy in America Factbook,” an annual review of the US energy industry prepared by Bloomberg New Energy Finance ltd. (BNEF) in partnership with the Business Council for Sustainable Energy.

“The resiliency of sustainable energy sectors is clear and enduring,” said Lisa Jacobson, president of the Business Council for Sustainable Energy, in the WSJ. “We know that the clean energy transition is already hard-wired into the U.S. economy, but recent federal policies have proven to be an important asset in accelerating technology deployment amid a turbulent market.”

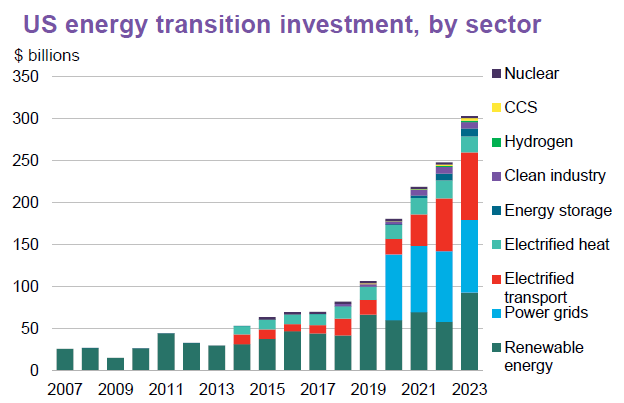

This is the 12th edition of the Factbook that builds from BNEF data with further detail added from government resources to provide investment trends and commentary on factors that are driving the energy transition in the US. Overall investment in the energy transition grew to 22% year-on-year to $303 billion in 2023 for clean energy technologies with particular growth in renewable energy and electrified transport. Plans for 104 manufacturing facilities were announced, representing $123 billion in investments, including 34 new battery facilities. The number also includes 34 new solar facilities following a record 23.7GW of large-scale solar came online in 2023, making up for supply chain delays that slowed progress in 2022.

Overall, 42 gigawatts of new renewable power-generating capacity were added to the U.S. grid. Electrified transport, which also includes charging infrastructure, was 35% of total US investment in 2023. Electric vehicle sales surged 50 percent to nearly 1.46 million vehicles sold.

US annual investment by sector

(Source: BNEF in partnership with BCSE)

Global energy transition investment exceeded $1.7 trillion in 2023 with most countries expanding on their previous contributions. The US has invested the second-largest portion, behind China at $676 billion.

Hydrogen remains a small but rapidly growing sector in the US, with BNEF estimating new hydrogen investment at $1.9 billion, up 82% from 2022. About 10.4 million metric tons of annual hydrogen capacity has been announced in the US. The US provides the highest level of supply-side support for hydrogen worldwide – the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act combine to provide as much as $20 billion in US government spending through 2030.

The emerging sector for carbon capture is also similarly supported by these acts enabling an anticipated 292% investment growth from 2020 to 2025 based on announced projects. By the end of 2023, the US had nearly 23 million metric tons/year of installed CCS capacity with $2.8 billion invested; 137 million metric tons/year have been announced across multiple output processes including ethanol, power generation, hydrogen and chemicals. Tax credits for CO2 storage or use have been boosted to $85/ton for point source, and $180/ton for direct-air capture projects.

The IRA is highlighted as “the most consequential US federal law ever intended to address climate issues,” a point hard to dispute. When passed in August 2022 the law became an important tool to halve US emissions by 2030 compared to 2005 and boost overall clean tech investment. Through December 2023, 104 cleantech manufacturing facilities had been announced, cumulatively representing $123 billion of investment.

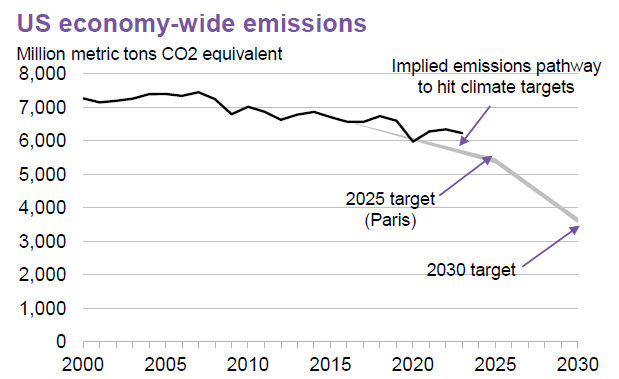

Although investment is up, emissions are not yet showing much improvement. The Factbook shows a small decline from 2022 with overall emissions remaining below pre-COVID levels. US emissions are now 16% below 2005 levels, although with uncomfortable deviation from the downward trend. Annual reductions of 6% per year in 2024 and 2025 are necessary to approach the Paris target (28% reduction), with more aggressive reduction to reach the 2030 goal.

US emissions lower in 2023 but still offtrack from Paris target

(Source: BNEF in partnership with BCSE)

US power generation continues to decarbonize as the portion of natural gas generation continued to expand, although emissions dropped less than 1% year-on-year. Natural gas now accounts for 43% of the total while coal continued its drop to 16%. Renewables grew to 23% of generation, led by rapid growth in solar in the southeast, southwest and Texas. Wind power growth slowed as tax credits became less certain and permitting issues lengthened timelines.

US electricity generation by fuel type

(Source: BNEF in partnership with BCSE)

One important correlation that emerged from the Factbook is the importance of resilience. In 2023 the US experienced 28 climate-related disasters. Such events are driving increased investment in energy infrastructure resilience, notably in the form of microgrids and energy storage systems.

Managing the increasing wildfire, weather and other disasters has become a major issue for utilities, just as they are challenged to integrate more renewable sources.

The Factbook is a great resource to track progress in emerging clean energy technologies, and the trends from the latest reports are encouraging. But there is much more investment needed to deliver on key emissions and efficiency targets. And the optimistic goals agreed at COP28 – to triple renewables and double energy efficiency – seem distant, but not yet out of reach.

Digital solutions are a fundamental enabler in many clean energy projects, and AspenTech is working with its partners and customers to develop new technologies. Our membership in the Business Council for Sustainable Energy helps to expand our industry collaboration to accelerate emissions reductions and strengthen resiliency.

.png?h=250&w=975&la=ja&hash=B078B4CE20DAFDD85B5C8DDC5F3DD5D2)

Leave A Comment